According to Furniture Today, the pandemic unsurprisingly fueled consumers’ “home goods” purchases. As pandemic restrictions ease, and even with consumer spending focusing more on experiences and travel, the “homebody economy” continues to flourish. Furthermore, this upward trend in consumer home goods spending is propelled by diminishing supply chain issues; among other factors. Overall, ad spend in the home goods industry should increase in step with consumer confidence in the category.

Below we take a look at 10 of these home goods (i.e. household maintenance, housewares, furniture/decor, home improvement/bldg materials, commercial furnishings, outdoor/garden, etc.) advertisers showcasing everything from washing machines to furniture, cleaning products to mattresses, and of course, vacuum cleaners.

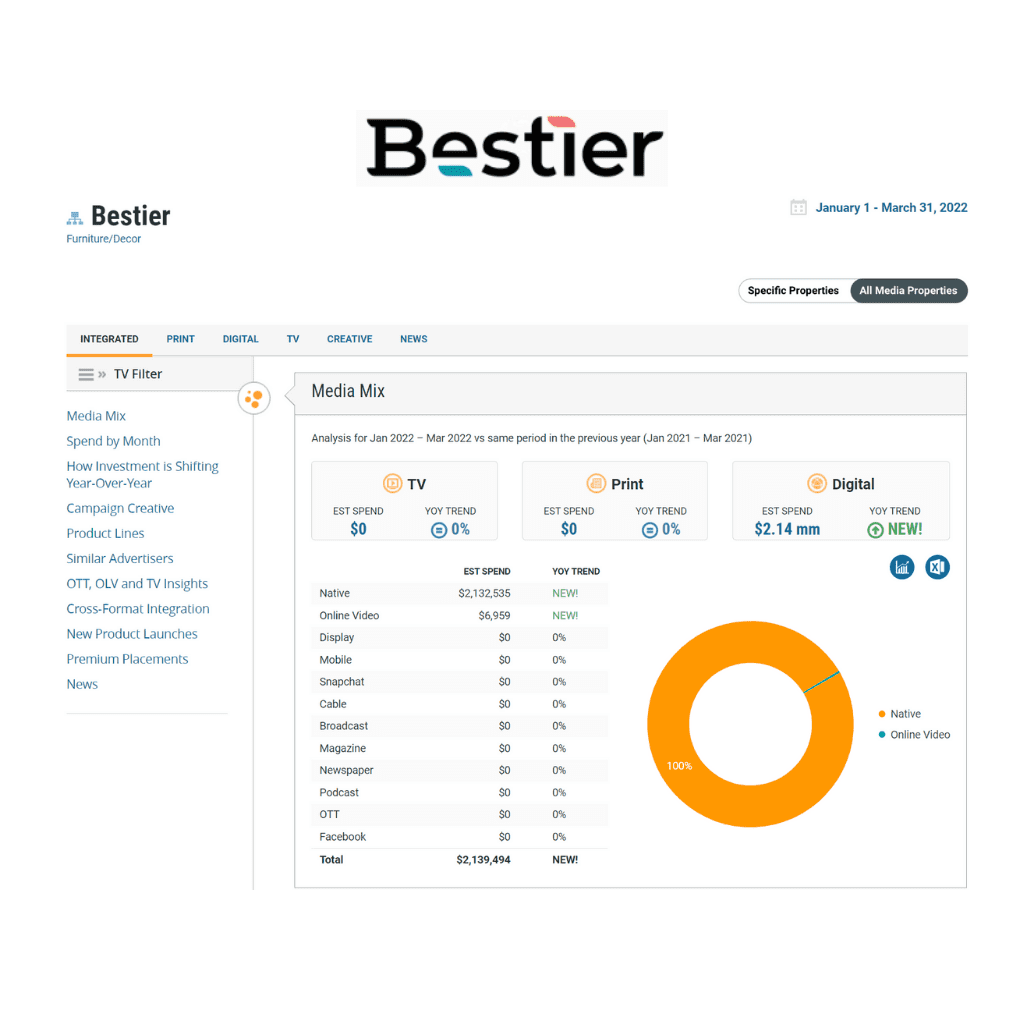

- 1. Bestier, the modern home furniture company brand, invested 56% of its ad spend towards furniture/decor ads and 44% towards home office furnishings ads during the first quarter of 2022. During this timeframe, Amazon received a staggering 99% of its ad investment and Target received 1%.

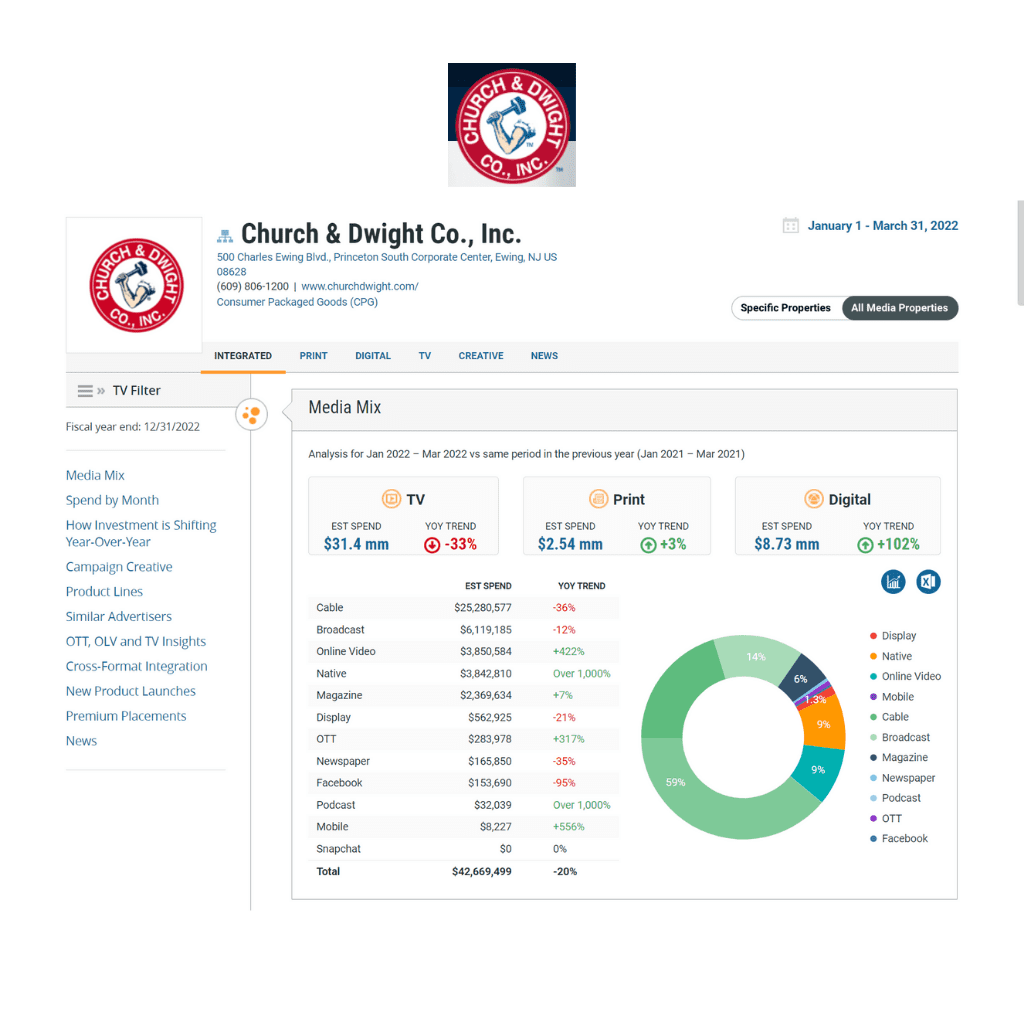

- 2. Church & Dwight Co. This American household products manufacturer, brings numerous brands into homes – but is probably best known for its Arm & Hammer line of products. In fact, Church & Dwight Co.’s Q1 2022 retail site advertising spend was 47% for its Arm & Hammer lines, 52% of its spend was devoted to Oxiclean products, and the remaining 1% was invested in ads for Kaboom. This year, they’re betting big on Walmart, which racked up 69% of Q1’s ad spend, Amazon received 22%, and the remaining 9% was split between Kroger, Target, and Albertsons.

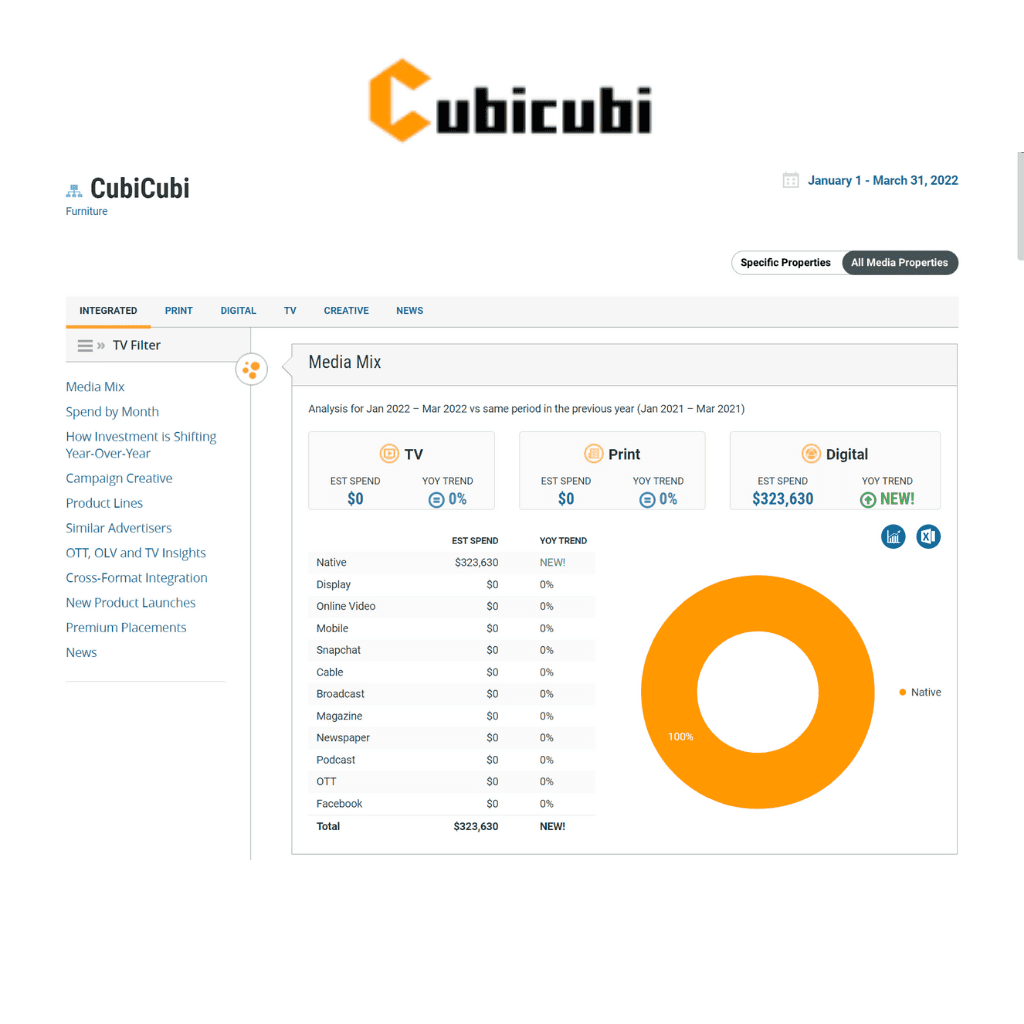

- 3. CubiCubi, the home office furniture company, carries three brands CubiCubi, Cubiker and DESINO. So far in 2022, 100% of its retail site ad spend went to Amazon. This new company (est. 2019), invested more than $1mm advertising its brands in the months of May, July, September, and October 2021.

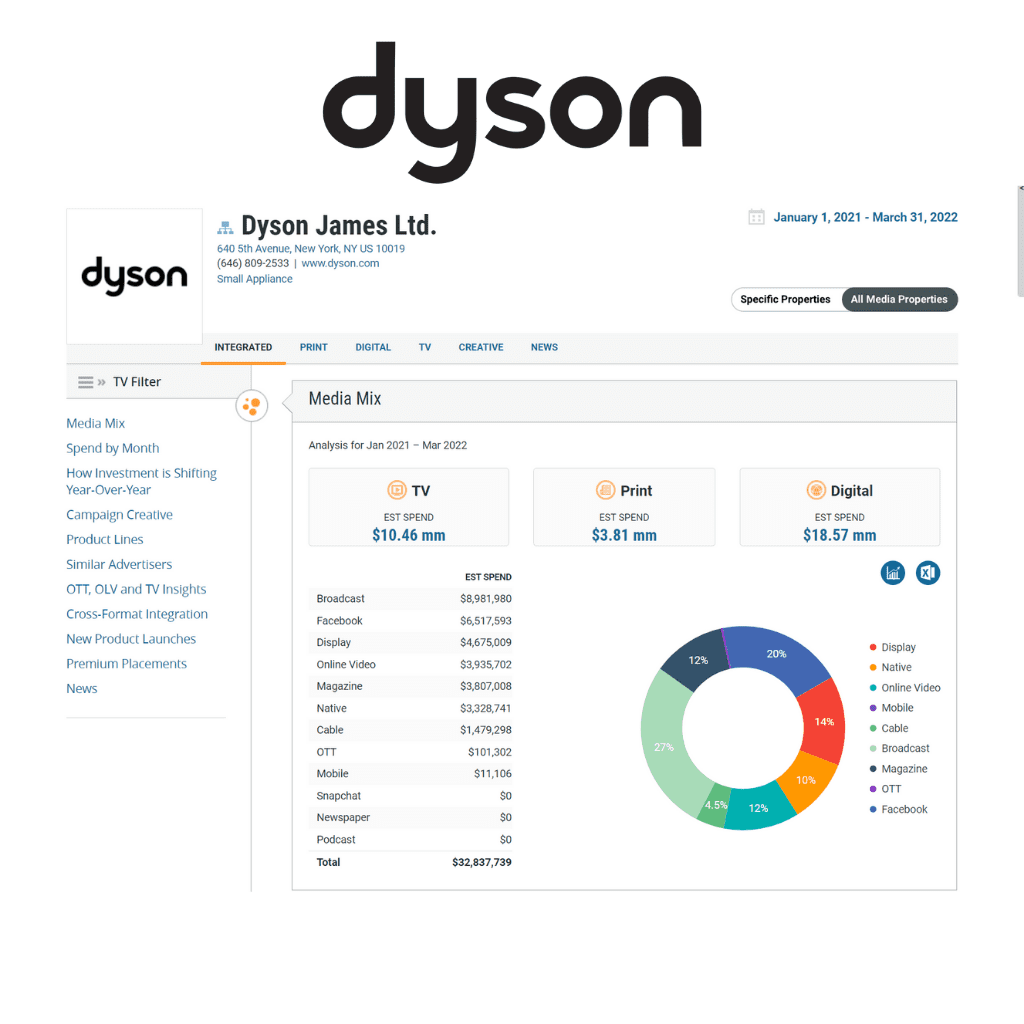

- 4. Dyson is a designer and producer of innovative vacuum cleaners, hair dryers, stylers, & fans and more. They invested over $4m in advertising during Q1 2022 and 44% of that spend went to retail sites. Clearly, they focus most of their ad spend on their popular line of vacuums. Last quarter, the majority (68%) of retail site advertising was for Dyson’s vacuums, 15% was for small appliances, 11% lighting and the remaining 6% was for air purifiers. Best Buy, a favorite for in-person as well as online shopping, received an incredible 93% of their retail site ad spend, while Target captured the rest.

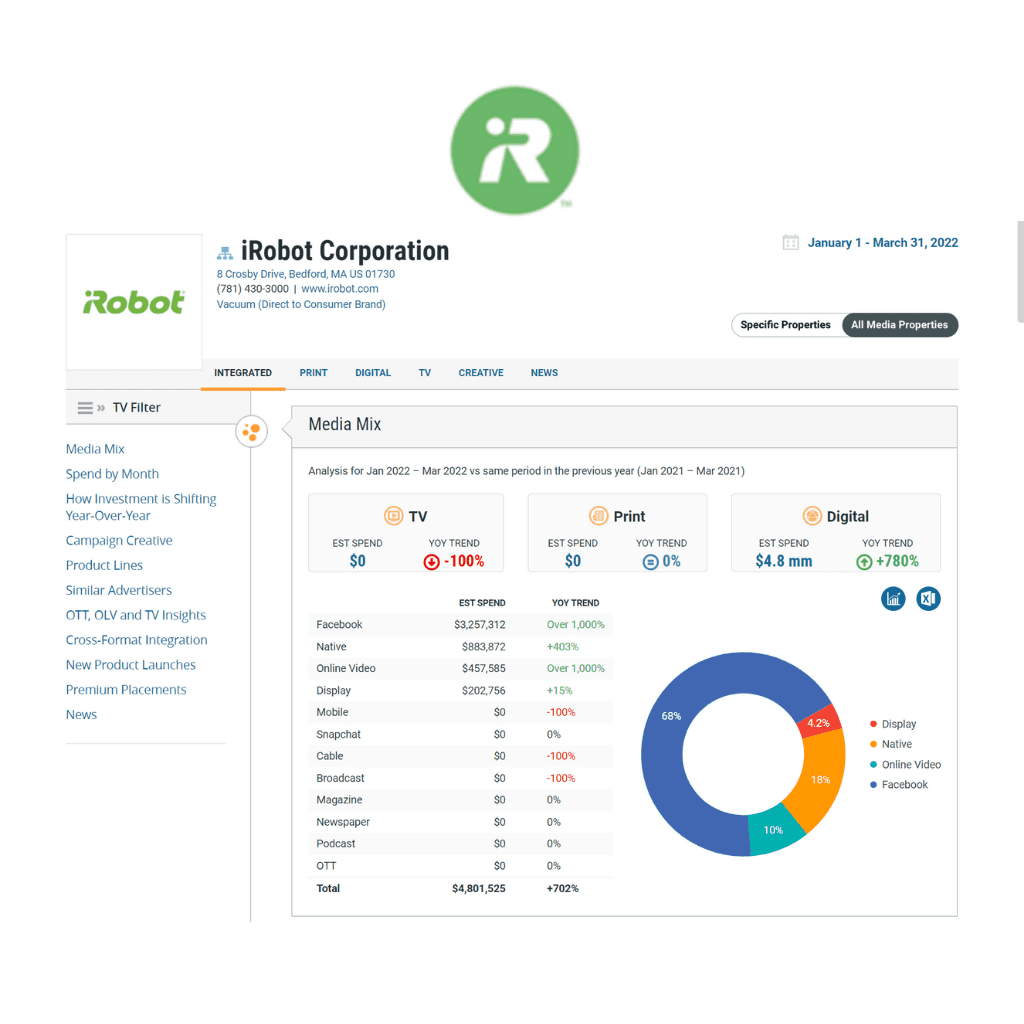

- 5. iRobot designs and builds innovative home robots, including the Roomba® robot vacuum and the Braava® family of mopping robots. iRobot invested more than $5mm in retail site advertising for their Roomba vacuum. In Q1 2022, similar to Dyson’s spend allocation, Best Buy held 93% of iRobot’s ad spend, followed by Amazon with 5%, and Overstock with 1%.

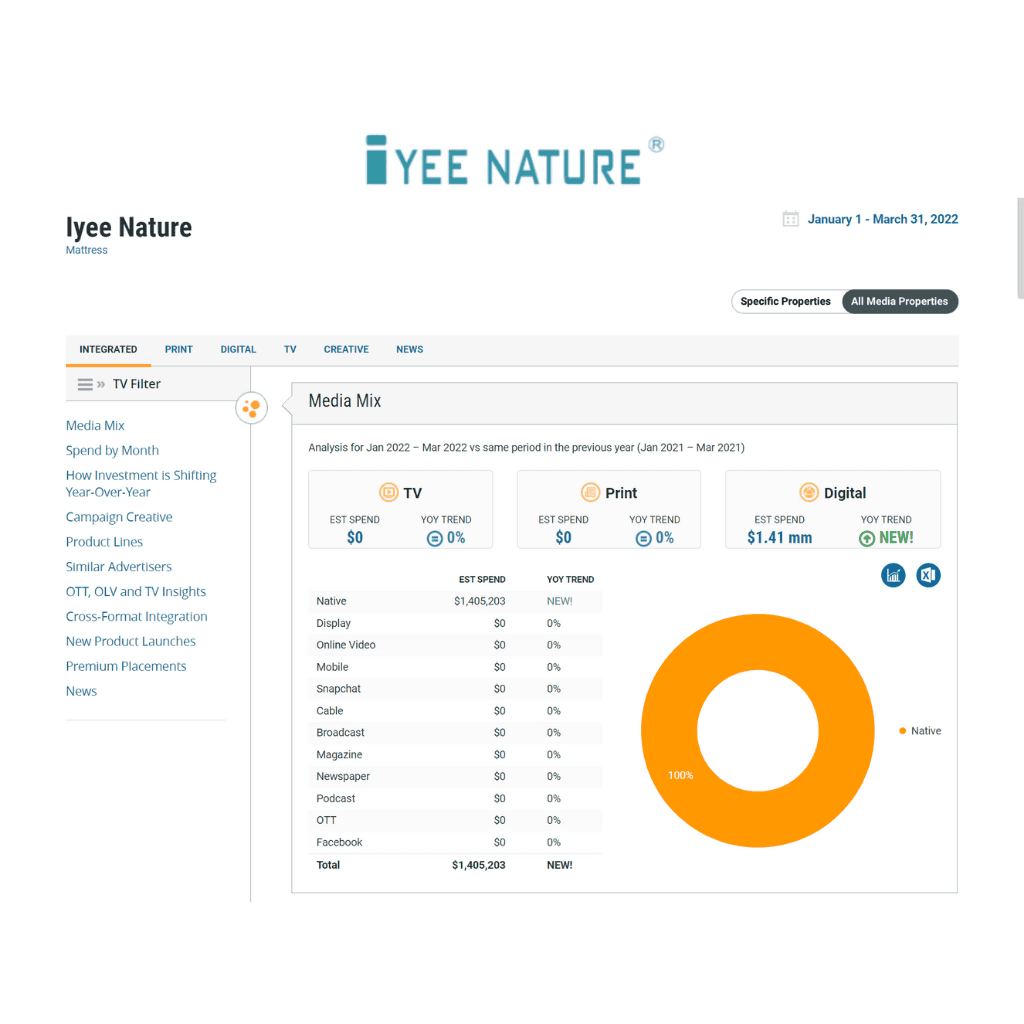

- 6. Iyee Nature offers a gel-infused memory foam mattress that helps keep sleepers cool – delivered directly to consumers. It’s evident Iyee Nature is betting big on Amazon. All ad spend (retail sites and other media) is 100% Amazon. Q4 2021 is responsible for 80% of last year’s spend.

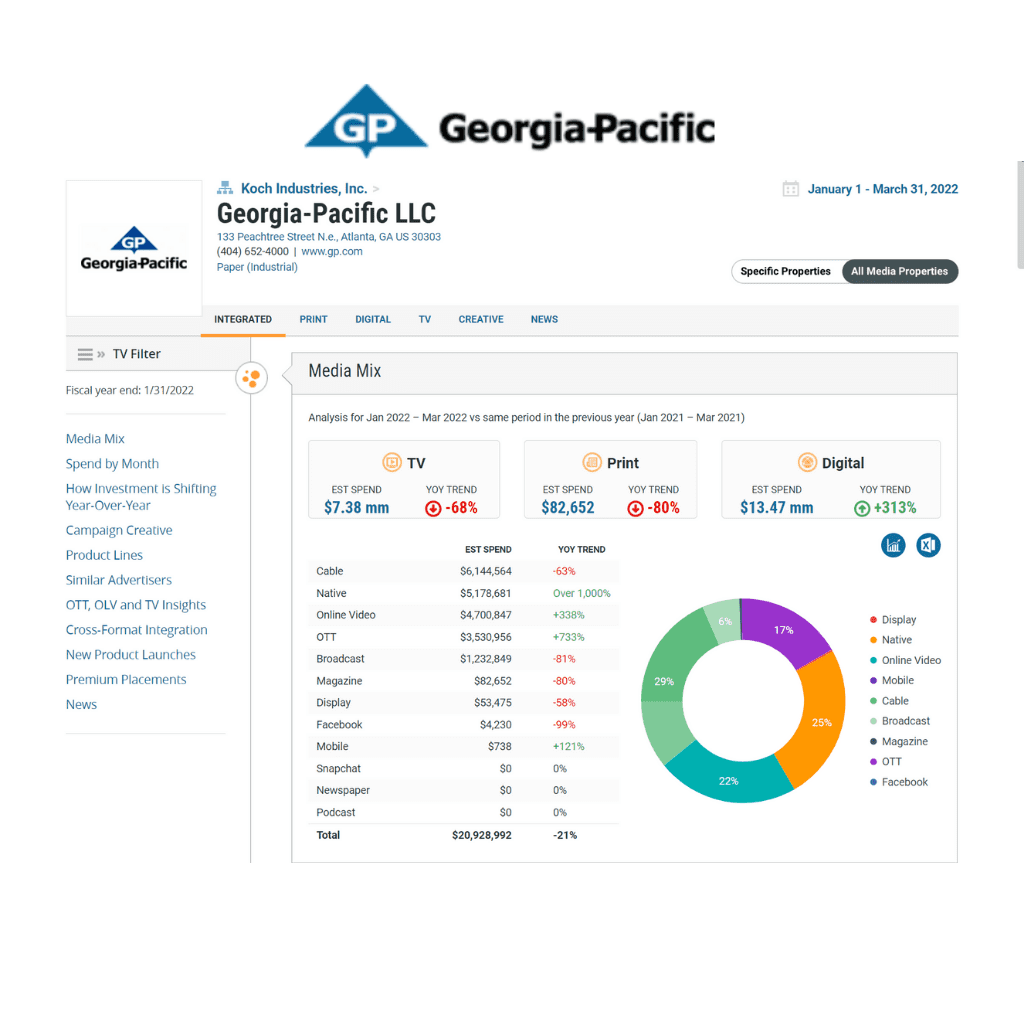

- 7. Georgia-Pacific is a household goods brand that ensures Americans are equipped with disposable plates/cups, paper towels and toilet paper. The company lands itself in the top ten spending on retail sites overall. In the first quarter of 2022, 58% of its advertising was for paper towel brands including Sparkle, 38% for toilet paper brands like Angel Soft and Quilted Northern, and the remaining spend went to Dixie and Vanity Fair (disposable plate/cup/napkin brands). Kroger leads in getting Georgia-Pacific’s retail site ad spend in Q1 2022 receiving over 54%. Walmart followed at 45%, and the remaining 1% went to Sam’s Club and Target.

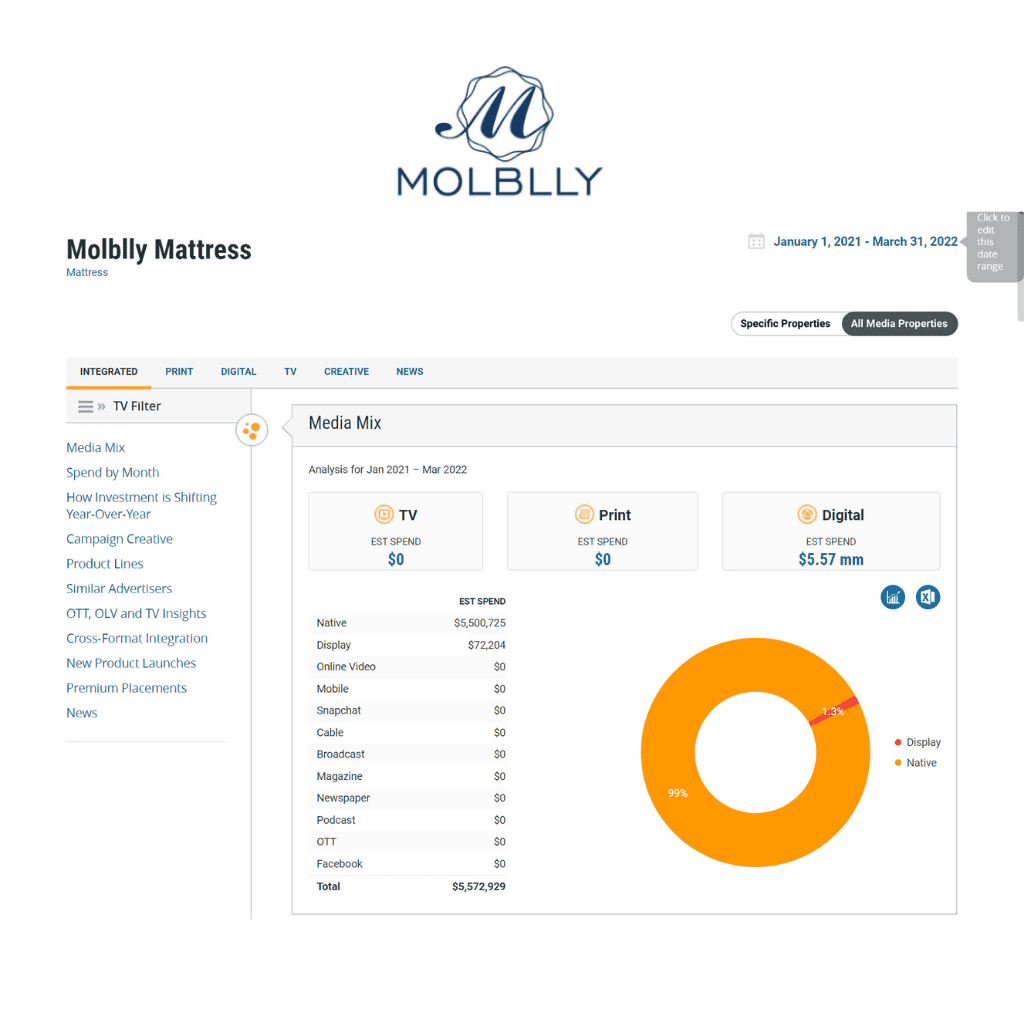

- 8. Molblly is a manufacturer of memory foam, hybrid and folding mattresses. Following a common route for DTC products like mattresses, in Q1 2022, 100% of their advertising went to retail site ads with Amazon capturing 100% of their $2.8m ad investment. This year’s first quarter’s ad spend is already 44% of what was spent over the entirety of 2021. Last year, Amazon captured an enormous 97% of their ad spend, while eBay received the remaining 3%.

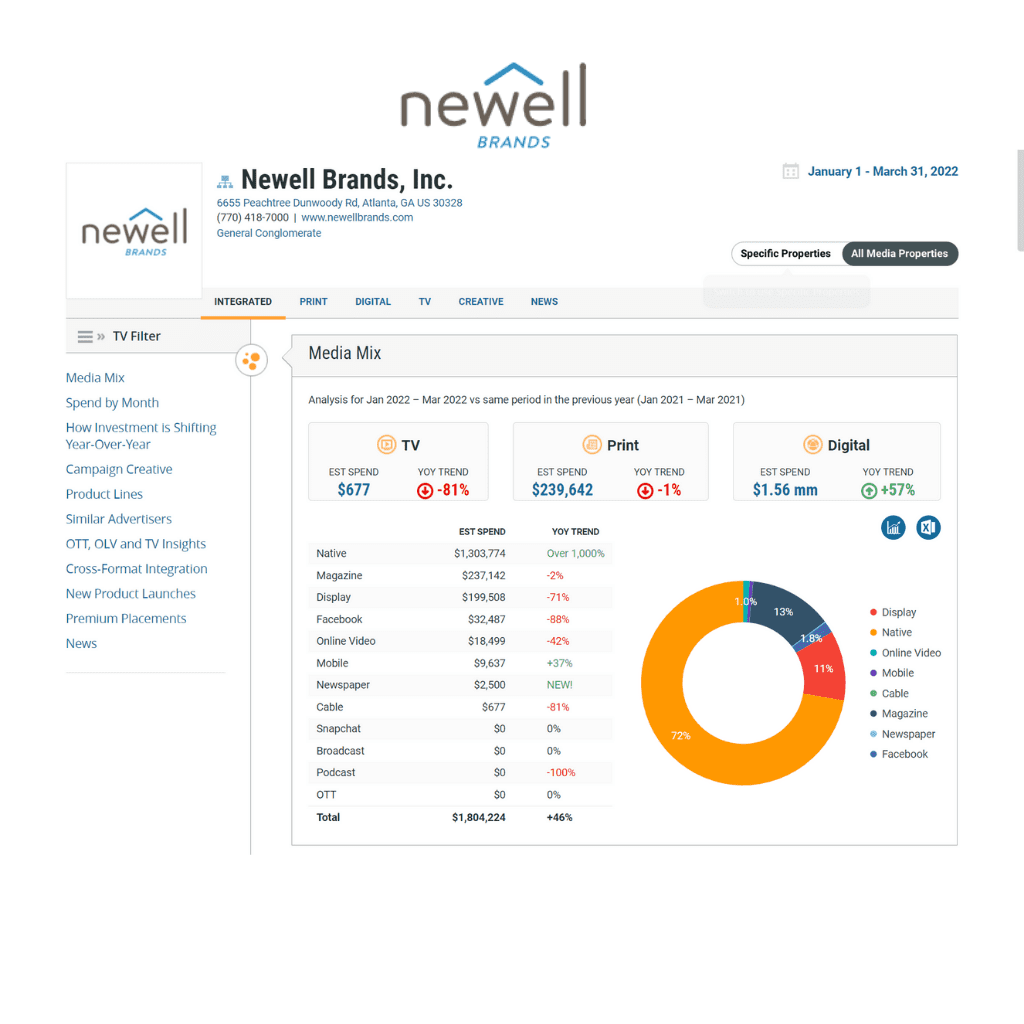

- 9. Newell Brands, offers consumers “planet friendly” home goods brands namely Rubbermaid. Other brands in their portfolio include Expo, Paper Mate, & Sharpie. During Q1 2022, Office Depot received 55% of their ad spend, Target 28%, and Walmart 14%. Amazon and Sam’s Club each received 1% of the retail ad spend. In the 2021 months, Rubbermaid was a top brand advertised and captured 20% of Newell’s retail site investment.

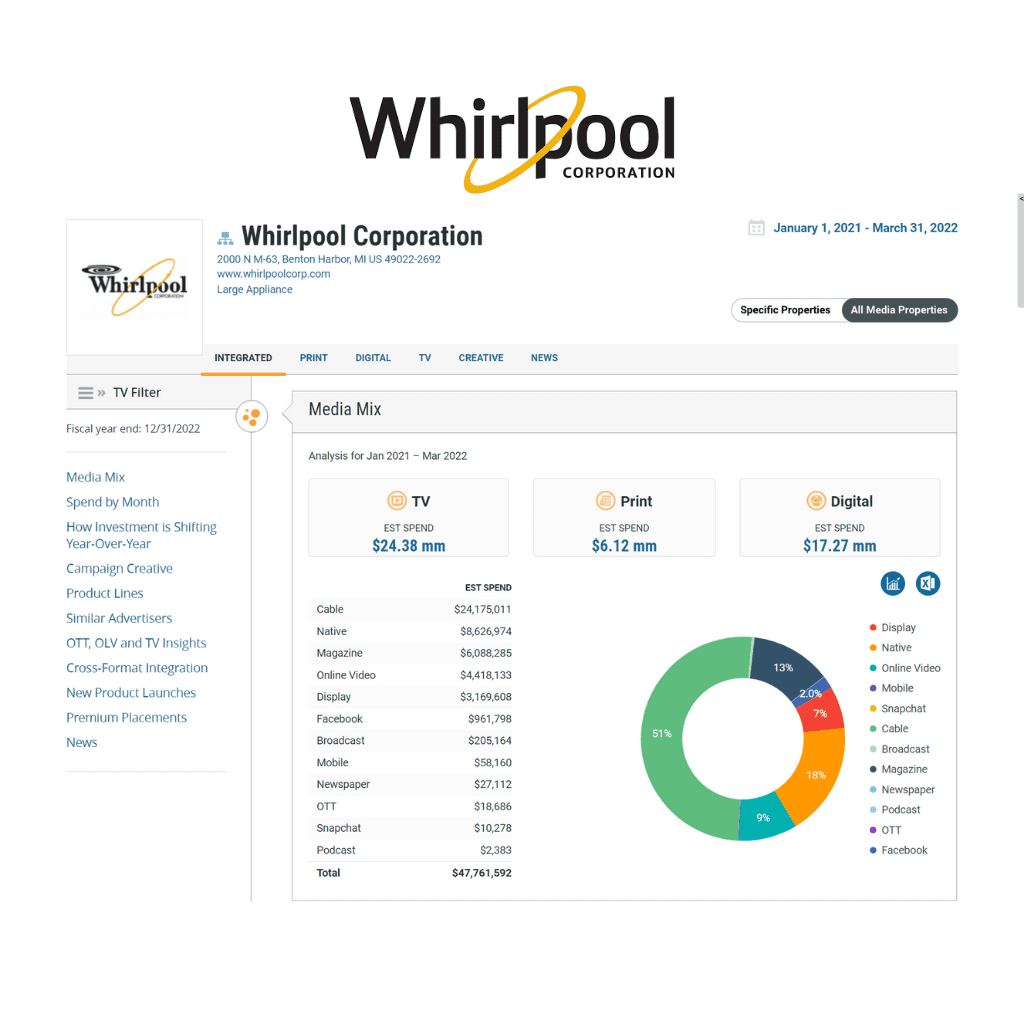

- 10. Whirlpool Corporation is a global kitchen and laundry company, with a robust portfolio of household brands. In Q1 2022, they invested over $6 million on advertising their brands: Affresh, Maytag, KitchenAid, SWASH and Whirlpool – on retail sites. Mega-retailer Walmart snagged 64% of the investment, followed by Amazon receiving 30% and Best Buy and Target receiving 5% and 1% respectively.